For the past year, everyone in Tunisia seems to be talking about “green hydrogen.” It’s a topic that’s truly hard to miss. But in a country where water already runs dry during the summer, a fuel made entirely from water raises a lot of critical questions.

For the Tunisian government and its international partners, it is a breakthrough that is being sold as Tunisia’s ticket to a clean energy future and foreign investment. Just across the Mediterranean, the European Union (EU) is deeply invested in this narrative. For Tunisia’s environmental groups and broader civil society, however, the narrative is complex. Legitimate concerns are growing that the project may be more extractive than transformative, raising critical questions about who will truly benefit from this green revolution. A great deal of important research has already been done by Tunisian activists and scholars, examining the different environmental and social shortcomings of Tunisia’s planned hydrogen future.

What is Green Hydrogen?

Fuels are substances that react with oxygen to release energy. Hydrogen (H2) stands out among these fuels because when you burn it, the byproduct is just water (H2O). On Earth, hydrogen is found combined with other elements, usually with oxygen in water. Using electricity, hydrogen from water can be harnessed and turned into fuel in the form of H2 gas. If this process is carried out using renewable energy like solar or wind power, then it’s called “green hydrogen.”

In terms of carbon emissions, green hydrogen is very low in emissions, producing water (H2O) as a byproduct instead of CO2 or greenhouse gases. Its strategic importance as a fuel lies in its versatility; it can be used to generate electricity as well as to produce heat, which is essential for decarbonizing sectors that are difficult to electrify, such as steel and cement industries. Furthermore, green hydrogen allows for the storage of excess renewable energy from intermittent sources, ensuring a stable energy supply when required. For these reasons, green hydrogen is poised to play a critical role in the environmental transition, particularly for industrialized nations striving for carbon neutrality, since electrification can only decarbonize to a certain extent.

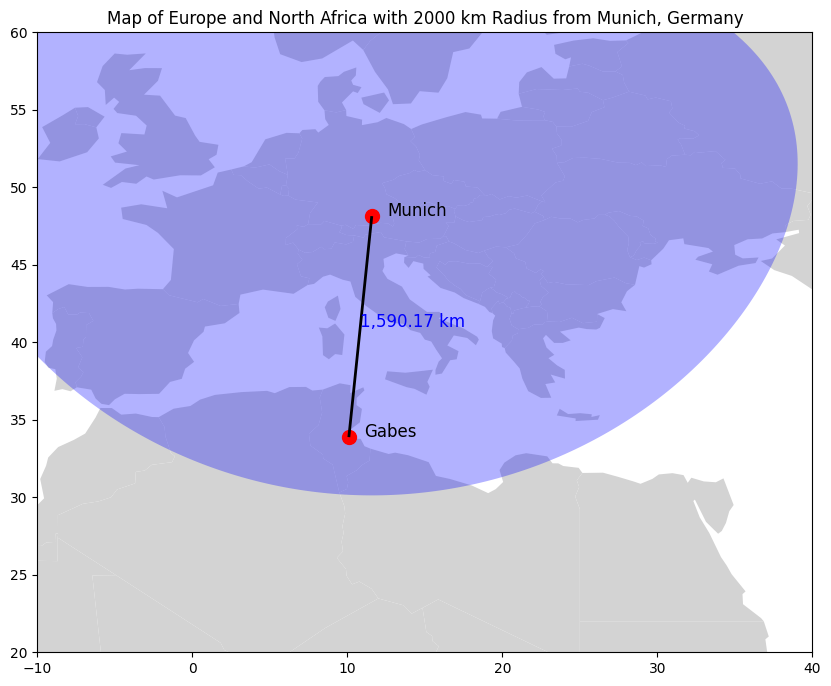

Finally, an important key fact is that hydrogen can be transported in two ways. The first is as pure hydrogen gas (H₂) through pipelines, much like natural gas, but this method is limited to relatively short distances of about 1,000 to 1,200 miles. The second option is to convert hydrogen into derivatives such as ammonia (NH₃), liquid hydrogen (LH₂), or methanol (MeOH), which can then be shipped over longer distances.

The Race for Green Hydrogen: Why Tunisia Holds the Key to Europe’s Energy Future

To understand why Tunisia is emerging as a key player in Europe’s green plans, it is essential to look at the EU Emissions Trading System (EU ETS) and its upcoming changes that are reshaping Europe’s energy strategy.

The EU Emissions Trading System (EU ETS) is central to Europe’s strategy for reducing greenhouse gas emissions. Based on the ‘cap and trade’ principle, it establishes a limit on the total emissions permitted from major sectors such as energy, manufacturing, and aviation. Companies are allocated emission allowances, each allowing the release of one ton of CO₂ equivalent, and they can trade these allowances in the market if they do not fully utilize them. Over time, the cap is lowered, increasing the cost of emissions and encouraging innovation and efficiency. Since its inception in 2005, the EU ETS has been responsible for a 47% reduction in emissions from the covered sectors, primarily through electrification and the expansion of renewable energy. However, the system in its current form is already encountering its limitations. In 2021, the European Union (EU) set more ambitious climate targets through the European Climate Law. This legislation requires a significant reduction in greenhouse gas emissions of at least 55% by 2030 compared to 1990 levels. To accomplish this, the EU implemented major updates to its Emissions Trading System as part of the “Fit for 55” policy package. This update, finalized in 2023, accelerates the reduction of emissions allowances from 2.2% per year to 4.3% per year from 2024 to 2027, and then to 4.4% from 2028 onward. Most critically, it introduces a groundbreaking mechanism with global implications. The Carbon Border Adjustment Mechanism (CBAM) represents a significant shift in the EU’s climate strategy, extending its green strategy beyond its own borders.

CBAM: a double-edged sword for European industry

CBAM functions by placing a price on the carbon emissions of the imported goods to the EU. This price is calculated based on the carbon price that would have been paid if the goods were produced under the EU’s Emissions Trading System (ETS).

The goal is twofold: to level the playing field for European industries competing with countries that have weaker environmental rules, and to prevent carbon leakage, where companies shift production abroad to escape carbon costs. By accounting for the emissions embedded in imported goods, the mechanism pushes both European and foreign producers toward cleaner practices, ensuring that the carbon footprint of products sold in the EU is measured regardless of their origin

Historically, European heavy industries received free emission allowances within the EU ETS framework to help them remain competitive on the global market. However, with the introduction of CBAM, this practice will be redundant; therefore, gradually phased out starting from 2026 and ending completely by 2034. Starting from next year, European companies will gradually start facing the full cost of their carbon emissions, prompting a scramble to maintain competitiveness. This move is the main driver of the push for green hydrogen.

By design, these implications will extend beyond Europe’s borders, and countries exporting to the EU will also feel the same pressure. This could spark a global shift toward a low-carbon future. Within a decade, countries that facilitate their industries in producing with the least emissions will be price-competitive and will benefit significantly from trade. On the other hand, industrialized countries where renewable energy is expensive will face substantial challenges in maintaining their competitiveness. For Germany, Europe’s leading industrial hub, finding a viable solution to this challenge is crucial.

In 2021 alone, Germany’s BASF, the world’s largest chemical company, generated a staggering 20.2 million tons of CO2 equivalents. Faced with rising energy costs and more stringent environmental regulations, the industrial giant has already begun shifting some of its production to China. Even though BASF is actively involved in the production of green hydrogen within Germany, it acknowledges that its price competitiveness hinges on access to imported hydrogen.

Hydrogen is indeed a fuel that theoretically can be produced in almost any country. However, from Germany’s perspective, particularly that of its Bavarian industrial giants, Tunisia holds unique potential. This stems from factors that are relatively straightforward to understand; however, navigating the complexities of such a project is not easy.

Hydrogen Gold Rush in Tunisia: Clean Energy Revolution or Risky Gamble?

In theory, a country like Tunisia could use its abundant solar resources to produce green hydrogen, especially during peak summer months when electricity generation often exceeds local demand. Converting this surplus into hydrogen would allow efficient storage, use, or export of energy that might otherwise go to waste. In reality, however, Tunisia’s renewable capacity remains extremely limited. Even though the country has every incentive to invest heavily in the energy transition, political instability and crippling debt have made the government unable to do anything on its own in terms of renewables. This, along with the country’s acute water stress, makes the path toward large-scale hydrogen production anything but typical.

Yet, within the EU’s strategic interest in establishing partnerships with Africa for renewable energy, Tunisia still has a very specific role to play with specific stakeholders that are set to benefit from it. Understanding this role will help us better evaluate our water-energy future options.

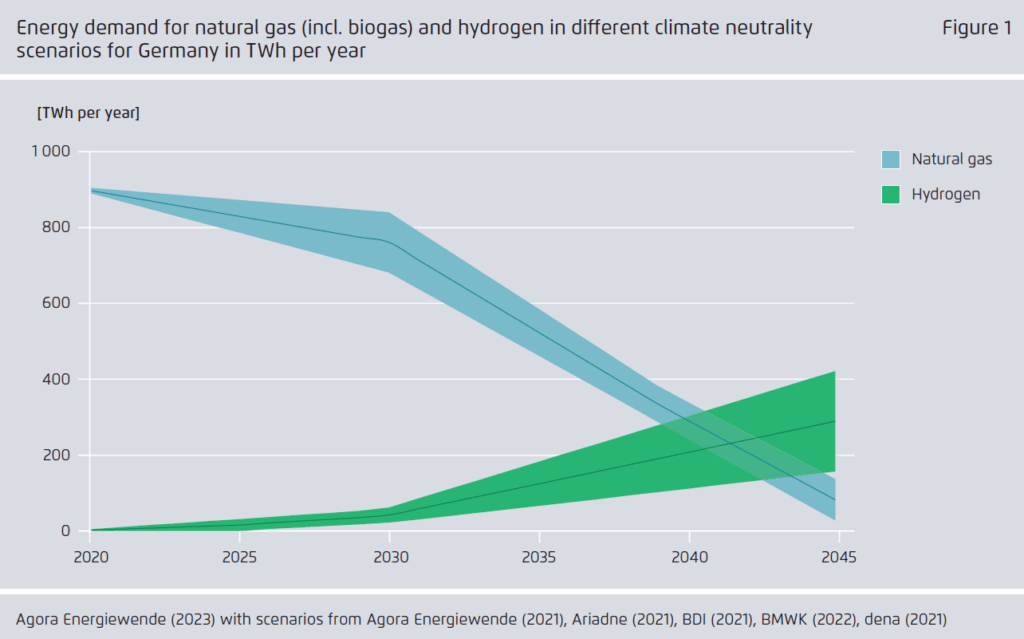

Germany’s drive to achieve climate neutrality is complemented by its interest in maintaining the competitiveness of its industries. The Russian gas crisis has accelerated its search for affordable and reliable alternatives to natural gas. In this context, green hydrogen is viewed not only as a tool for meeting climate targets but also as a pillar of energy security.

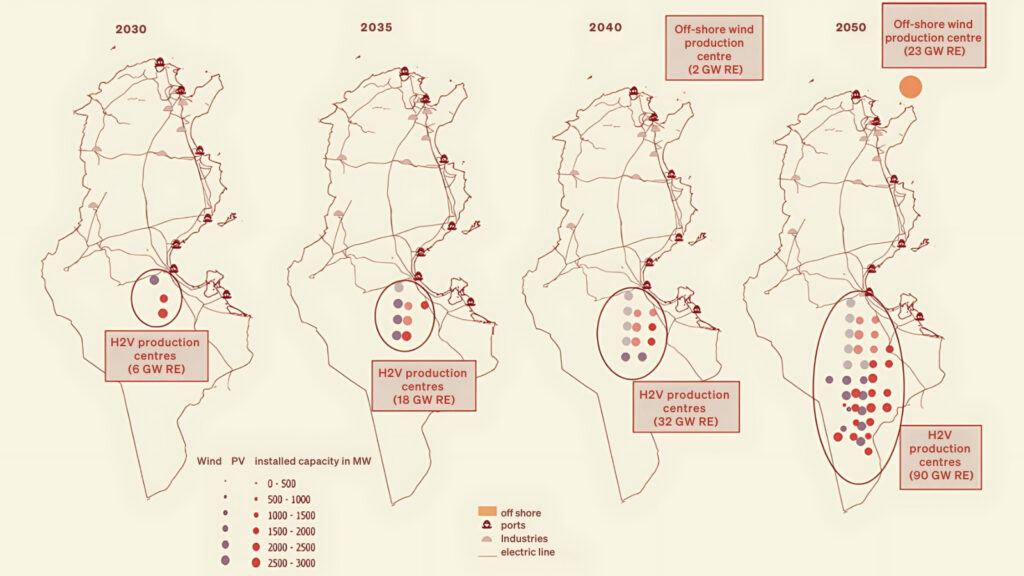

Recently, the German government has approved the hydrogen import strategy, with goals to import 50-70% of its hydrogen by 2030. The initial suppliers are expected to be Norway, Britain, and Denmark, while larger ‘corridor’ pipelines are being prepared to import hydrogen at scale in the future. The SoutH2 Corridor pipeline project is set to deliver 4 million tons of green hydrogen per year from Tunisia and Algeria to central Europe, mainly to Italy, Austria, and Germany.

According to Germany’s plan, existing pipeline infrastructure is the main factor in identifying potential hydrogen suppliers, and Tunisia is uniquely well placed. The Trans-Med pipeline linking Tunisia and Italy already connects to central Europe, making exports to Germany both feasible and the most affordable option. Coupled with Tunisia’s strong solar and wind potential, this gives the country a competitive edge, with final delivery costs estimated at $1.5 to $3 per kilogram. By contrast, shipping hydrogen from elsewhere would cost around $5 to $6 per kilogram, an important difference if you are trying to compete with rapidly decarbonizing countries like China.

What to Expect for Tunisia

For these reasons, Tunisia has already seen the announcement of three major green hydrogen projects, signaling its entry into the global hydrogen market:

H2 NOTOs Project: A collaboration between Austria’s Verbund and TotalEnergies’ subsidiary TE H2, this project aims to produce 200,000 tons of green hydrogen annually, with the potential to expand to 1 million tons in the long term.

Saudi ACWA Power Project: This initiative plans to generate 200,000 tons of green hydrogen per year, powered by 4 GW of renewable energy. The long-term objective is to increase production to 600,000 tons annually, backed by 12 GW of renewable energy capacity.

HDF Energy Project: This project involves a €3 billion investment to develop Tunisia’s first large-scale green hydrogen facility. Utilizing 1 GW of wind power, 500 MW of photovoltaic energy, and 800 MW of electrolysers, it aims to produce up to 65,000 tons of green hydrogen per year, with exports routed through the SoutH2 Corridor to Europe.

These projects collectively aim to produce 465,000 tons of green hydrogen per year. It will require 9.3 to 18.6 million tons of seawater annually as a source of hydrogen, generating 4.65 to 9.3 million tons of brine as a byproduct, and consuming 9.5 GW of renewable electricity. While these projects could make Tunisia an important supplier in Europe’s hydrogen economy, they also raise serious concerns. Tunisia risks giving up land, water, and energy at a low cost while carrying the environmental and social burdens.

Critics warn of a neo-colonial dynamic, particularly as millions of tons of brine from hydrogen production threaten marine ecosystems along the Tunisian coast. At the same time, directing large amounts of renewable energy toward hydrogen could slow progress in solving Tunisia’s urgent water and electricity shortages. Supporters argue that foreign investment might bring cheaper renewable power and new desalination technologies, but this positive outcome is far from guaranteed. It will only be possible with clear policies, transparent governance, and a fair distribution of benefits.

The real question is whether hydrogen becomes just another resource taken from Tunisia, or whether it can create lasting opportunities for sustainable development. Without decisive action, Tunisia risks becoming a resource provider for Europe’s green transition, carrying the costs while capturing few of the rewards. The stakes are high, and the time for policymakers to negotiate fair terms is now. Rather than simply exporting resources, Tunisia has the chance to shape a hydrogen strategy that serves both its people and protects its environment.

To seize the opportunity, Tunisia must aim beyond just exporting hydrogen. It should identify manufacturing sectors that can be powered with hydrogen at home, negotiate quotas of desalinated water to secure its cities’ supply, and design creative policies that channel investment into projects that directly benefit both people and the environment. With strong initiative, hydrogen could become more than an export commodity.

Copyright © 2025 Blue Tunisia. All rights reserved